For more than 20 years, Artisan Partners has been identifying unique investors and partnering with them to build investment franchises with stable and multi-generational leadership, repeatable investment processes and track records of successful outcomes for clients.

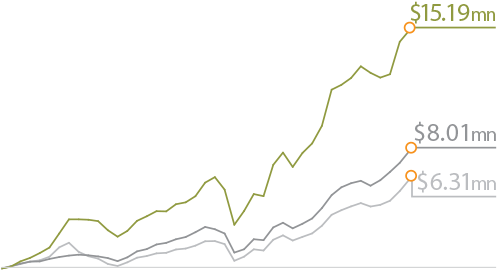

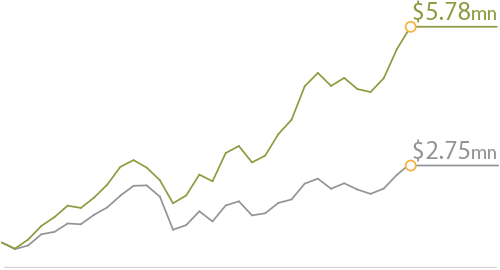

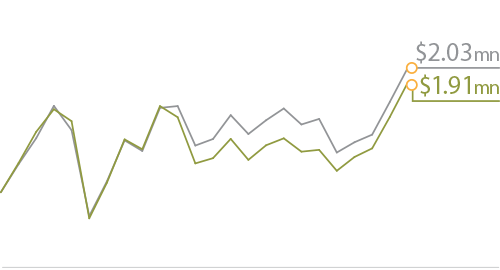

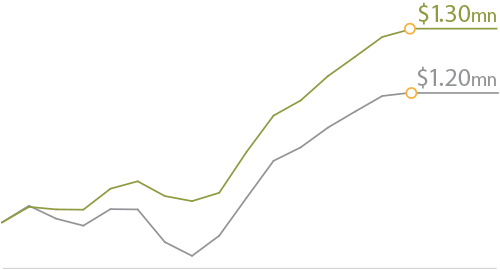

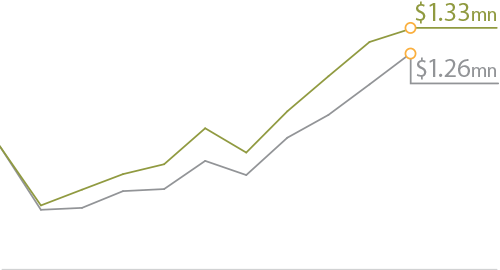

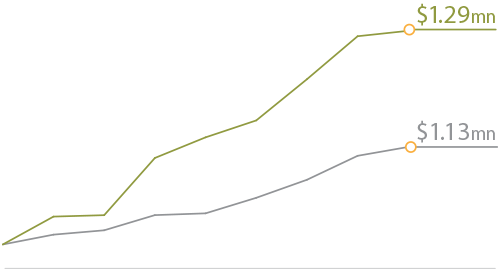

$1 million invested in each of our investment strategies launched prior to 2017 (a total investment of $15 million) would have grown to $73.5 million as of December 31, 2017, after fees. That’s $23 million (46%) more than a portfolio consisting of each strategy’s broad-based benchmark index.

The Artisan outcome is a product of our unique investment talent working within a model and culture designed specifically for them to achieve long-term investing success. We provide investment autonomy and comprehensive business support. Investment autonomy results in a pure investment process and accountability for investment outcomes. Comprehensive business support minimizes distraction and maximizes the probability that a talented individual will develop into a team and ultimately into a multi-generational franchise.

This personal and intricate process of partnering with talented individuals to unlock and realize potential across time and through generations is what we mean by Talent as an Art.

In this report, we describe Talent as an Art in greater detail. We have also included, as a case study, the story of Andy Stephens, who founded our Growth team and, over the last 21 years, partnered with us to develop a successful investment franchise.

We have a clear vision of the type of investment leaders we are looking for and a repeatable process for finding, recruiting, onboarding and partnering with those leaders to develop investment franchises.

Our business management team is responsible for executing this process. Unlike many investment firms, the members of our management team do not have any investment research or decision-making responsibilities. This secures investment autonomy for our investment teams and provides our management team with the necessary time and objectivity to identify and recruit new investment talent and support existing investment talent.

We have multiple sources for identifying new talent, including our existing investment teams, internal research and external recruiters. We also receive many reverse inquiries from talented investors interested in joining us. These networks generate numerous leads for us to consider each year.

Our evaluation process is focused on determining whether an individual possesses the characteristics we’re looking for and would be a good cultural fit for Artisan. In making this evaluation, we assess individuals across multiple dimensions and from multiple perspectives. We draw on our management team’s experience, as well as the knowledge and judgment of our existing investment talent, our board of directors and our contacts across the investment industry.

If we believe an individual is promising, we work to build a relationship and, eventually, partner to align expectations, economics and risks. We only move forward when we think there is a high probability of a successful long-term outcome. We remain objective, disciplined and patient through the entire process. We are careful to avoid mistakes.

Once we partner with a new investment leader, we provide comprehensive support to minimize start-up distraction and maximize the probability of success. We commit significant resources to recruiting research analysts and traders, obtaining and building technology, sourcing data and information, giving a team its own four walls and raising seed capital. After the initial build-out period, our management team remains actively involved with each investment team. We work with each team to develop and maintain a healthy and growing investment franchise, which is our ultimate goal across all the teams.

We look for unique investors who are passionate about their investment philosophy and who want to lead an investment team, own an investment track record and build an investment franchise in a distraction-free environment.

Our Growth team is an excellent example of an investment franchise consciously developed over time. The team’s founder, Andy Stephens, joined Artisan Partners in 1997. Andy designed a repeatable investment process focused on accelerating profit cycles and systematic capital allocation. He identified and hired talented people who shared his tireless work ethic. That process and those people evolved into a robust franchise with a broad research platform, a unique culture, a distinctive brand and proven results.

Today, Jim Hamel—who was Andy’s first hire in 1997—leads the Growth team, along with portfolio managers Matt Kamm, Craigh Cepukenas and Jason White, who each have been with Artisan for more than 15 years. Applying the philosophy and process originally designed by Andy, the Growth team currently manages over $30 billion in four investment strategies for clients located around the world.

After a multi-year transition process, Andy retired from Artisan Partners in March 2018. The Art of Franchise Development section tells the story of his career. I encourage you to read it. You will learn about Andy and the Growth team. You will also gain a deeper understanding of the type of talented and passionate people we attract and how we partner with them to generate successful outcomes across generations.

Keep in mind, though, that developing an investment leader into a team and a team into a franchise is highly individualized and personal. With unique and autonomous investment leaders, no two paths will be the same. That is evident in the diversity—in terms of investment philosophy, team structure and culture—among all of our investment teams, including our newest teams: Credit, Developing World and Thematic.

Each of these 3 teams was founded over the last 5 years by a talented individual who joined Artisan to execute his investment philosophy and process free of centralized research or decision-making and—like Andy Stephens 21 years ago—to design and build an investment franchise specifically for the purpose of executing that philosophy and process.

Bryan Krug joined us in 2013 and founded the Artisan Partners Credit Team. In 2014, we launched the team’s first strategy, the Artisan High Income Strategy, diversifying our business into fixed income investing.

Lipper recently recognized the Artisan High Income Fund as the best of 154 funds in the High Yield category over the last 3 years. Over that same period the Credit team grew its AUM at a quicker rate than any previous team in our history. In 2017, we took another step in developing the franchise by launching the team’s second strategy, the Artisan Credit Opportunities Strategy.

A little more than a year after Bryan joined Artisan, Lewis Kaufman joined the firm and founded the Artisan Partners Developing World Team in San Francisco. The team’s first strategy, the Artisan Developing World Strategy, is a differentiated take on the emerging markets asset class. It is designed to deliver an emerging markets outcome with less risk. From inception through December 31, 2017, the strategy generated average annual returns of 12.07%, after fees, compared to 9.71% for the MSCI Emerging Markets Index. The Developing World strategy’s returns have also been less volatile than those of the index and draw-downs have been less severe. At December 31, 2017—six months shy of the strategy’s third anniversary—the strategy had $2.3 billion in AUM.

Lastly, Chris Smith joined us in October of 2016 and founded the Artisan Partners Thematic Team. He is the first portfolio manager to join Artisan with a background predominantly in long/short investing. As with Bryan and the Credit team, our partnership with Chris and the Thematic team demonstrates that our model works beyond long-only equity investing. We have broadened our capabilities and further diversified our business.

In 2017, we launched two strategies managed by the Thematic team, the Artisan Thematic Strategy and the Artisan Thematic Long/Short Strategy, both of which have had strong early performance. Testifying to our firm’s model and capabilities, Chris often says that partnering with Artisan gives his team “operational alpha.” That is precisely what we aim to do.

An important part of developing talented investors is providing them with sufficient investment flexibility to express their views, generate outcomes for clients and differentiate their strategies from index-based and other products.

We refer to this investment flexibility as degrees of freedom: broader investable universes, fewer constraints, and more techniques for expressing an investment viewpoint and managing risk. Degrees of freedom can be as simple as allowing a strategy to hold more cash or concentrate capital—or much more pronounced, as in the Credit Opportunities and Thematic Long/Short strategies, both of which have broad investable universes and the flexibility to take short positions and use leverage.

Degrees of freedom increase the universe of differentiated outcomes—both good and bad. Therefore, as degrees of freedom increase, so too must investment discipline and risk awareness—two traits that have always been important to our investment teams.

For more than a decade, we have been working to increase degrees of freedom across our investment strategies—including in our first-generation strategies launched between 1995 and 2002. These strategies are designed for asset allocators looking for alpha within relatively narrow investment parameters—such as market capitalization and geographic constraints. Over the years, working with our clients, we have incrementally decreased many of the original constraints, providing our investment teams with greater degrees of freedom.

Our global strategies, which we began launching in 2007, provide the investment teams with broad flexibility to invest across geographies. And our newest strategies—beginning with the High Income strategy—represent another step in the direction of greater degrees of freedom. The Credit Opportunities and Thematic Long/Short strategies have the broadest degrees of freedom of any of our strategies launched to date.

Using these additional degrees of freedom, we believe that our investment talent has generated—and will continue to generate—differentiated and compelling outcomes for clients. We expect to continue to work toward greater degrees of freedom in existing strategies and with new strategies we launch in the future.

Another important part of our talent-centered model is the design and operation of our distribution efforts. In those efforts, we aim to minimize investment team distraction and prioritize the experience of existing clients. This approach requires discipline and sometimes sacrifices short-term flows in the interest of long-term outcomes.

Each of our investment teams has one or more dedicated business leaders who take the lead with traditional institutional clients and liaise with our sales teams dedicated to intermediary, defined contribution and non-U.S. channels. We target sophisticated asset allocators because they usually have longer term investment horizons that better align with our investment strategies. Long-duration assets create stability for our investment talent, allowing them to maintain investment discipline through difficult environments. Our goal is to put together a healthy mix of these sophisticated clients across distribution channels, geographies and investment vehicles.

To protect our teams’ ability to generate returns for existing clients, we manage the total AUM invested in strategies, as well as the timing and velocity of client cash flows. Currently we have closed, or placed significant limits on new investments into, 7 of our 17 strategies, including our 5 largest strategies. Our fee rates are a primary tool for matching capacity with episodic demand. Establishing and managing fee rates over time is complex; a number of factors are relevant, including strategy capacity, investment vehicle, client characteristics, performance outcomes, and competition for and retention of investment talent. One factor that is not relevant is short-term organic growth. We do not compromise on fees in order to pad our flow results. We prefer to remain patient and find the right client on the right terms, which we believe leads to better long-term outcomes for everyone.

Since 2013, we have experienced approximately $8.1 billion in firm-wide net outflows, primarily as a result of outflows from our two U.S. mid-cap strategies. Aggregate numbers, though, don’t tell the full story. Over the same time period, 6 of our 8 investment teams and 11 of our 17 current strategies have positive net flows. We are confident that prioritizing investments, not distribution, contributes to successful investment outcomes—which, over time, will result in plenty of long-term demand for our investment strategies.

In 2017, we continued to make significant advances in talent-development and degrees of freedom, including:

We accomplished these things while generating strong investment performance for our existing clients and maintaining business discipline. We continued to generate high margins and distribute all of our earnings to our owners.

Artisan Partners’ success is not based on a single investment philosophy, or centralized investment research or decision-making. The common denominator is our business model and process. We give talented investors a unique combination of autonomy and support. We understand that each investment team’s path to a sustainable investment franchise will be different. We provide each team with individually tailored support and guidance. Our model and process have generated successful outcomes across eight autonomous investment teams and multiple asset classes, time periods and generations.

What we do is repeatable.

Remaining disciplined, we expect to continue to generate successful outcomes—for clients, talent and owners—long into the future.

Sincerely,

Eric Colson

Chief Executive Officer

Artisan Partners

As of March 31, 2018. Team compositions are subject to change.

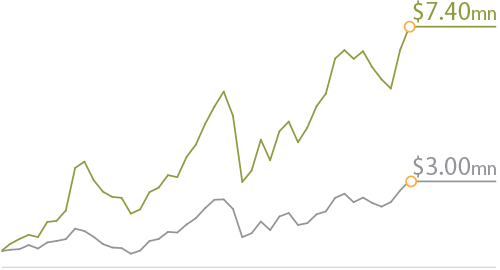

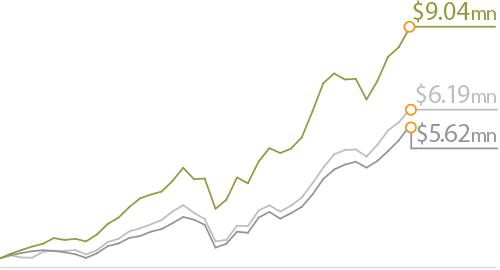

Data as of and through December 31, 2017. Sources: Artisan Partners/MSCI/Russell/ICE BofA Merrill Lynch/S&P. The strategy presented for each team is the first strategy launched by each team, except for the U.S. Value team. The U.S. Mid-Cap Value strategy is the strategy with the longest track record currently managed by the U.S. Value team. The growth of $1 million calculation is based on investing $1 million, with monthly returns net of investment advisory fees, in each Artisan composite and its broad-based market index and style index, if applicable, for the period since the composite’s inception through December 31, 2017. An investment cannot be made directly in an Artisan composite or a market index and the results are hypothetical. Past performance is not indicative of future results. For investment performance of each strategy currently managed by Artisan’s investment teams, see Investment Performance section.