In the investment management business, success occurs when clients make money on both an absolute and relative basis. That requires attracting client assets and then outperforming over a prolonged time period. Artisan has done that consistently over time, and 2017 was no exception.

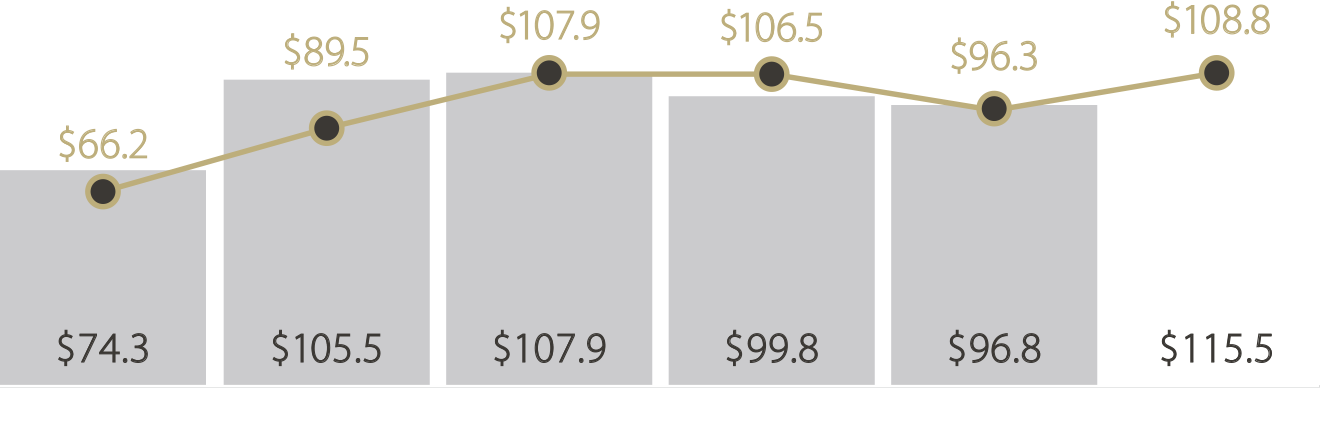

In 2017, Artisan’s AUM increased $18.6 billion or 19% from $96.8 billion to $115.5 billion at December 31, 2017. Most of that growth was due to appreciation in global equity markets. But that doesn’t mean we, or our clients, were just lucky. We put ourselves and our clients in the position to benefit from 2017’s rising markets. In addition, on an asset-weighted basis, Artisan’s strategies outperformed their respective benchmarks by 325bps, translating into approximately $2.6 billion of additional client AUM.

Further breaking down the increase in AUM in 2017, clients contributed $16.4 billion of new money into Artisan’s strategies and withdrew $21.8 billion, resulting in $5.4 billion of net outflows. Net outflows from our Non-U.S. Growth and U.S. Mid-Cap Growth strategies accounted for more than 100% of firm-wide net outflows. Both of those strategies have had difficult short-term relative performance, but longer term performance has been strong.

Strong long-term performance can result in clients re-balancing away from a strategy. We estimate that re-balances accounted for approximately $1.9 billion of our outflows in 2017. We think it is important to maintain perspective and appreciate that in many cases client withdrawals—sometimes very large withdrawals—are actually the product of our success.

Revenues for the year ended December 31, 2017, rose 10% to $795.6 million on average AUM of $108.8 billion. Operating expenses rose 8% primarily from higher compensation costs, a significant portion of which vary directly with revenues. We also invested in our eighth investment team, launched four new strategies, and granted additional equity to employees. Even with those additional investments, our adjusted operating income rose 14% to $299 million and our adjusted operating margin improved to 37.6% from 36.4%.

Our financial model continued to operate as designed, and we returned all the cash we generated from operations to our shareholders in the form of quarterly and special dividends, which totaled $3.19 per share with respect to 2017, compared to $2.76 per share with respect to 2016.

At Artisan, our measure of success is investment performance for clients, not net client cash flows. Investment performance generates wealth for existing clients and will result in growth over the long term and continued success for clients, shareholders and the firm.

Sincerely,

Charles (C.J.) Daley, Jr.

Chief Financial Officer

Artisan Partners