A well-designed investment franchise brings stability, repeatability and durability to the investment world where uncertainty and cyclicality are the norm and linear outcomes are rare. How do you build an investing process that delivers results for clients and is also capable of outliving the people currently driving it? After a multi-year and fully transparent transition process, Andy retired from Artisan Partners in March of 2018. The transition of leadership from the team’s founder to the team’s current portfolio managers was the culmination of two decades of planning and hard work to build an enduring investment franchise. Today, the Growth team franchise is as strong and capable as it has ever been.

A consequence of Andy’s upbringing in semi-rural Wisconsin was his grit and desire to be a successful builder…of something. After college, he got his professional start at Strong Capital Management—not on an investment team but answering phones in the call center. He eventually moved to information systems and then the trading desk, which he began managing soon thereafter—all while developing his own investing philosophy. Those efforts were rewarded when Strong needed a new portfolio manager—Andy was a logical fit given his breadth of experience and willingness to dive in, roll up his sleeves and build.

Though initially trained as a more value-focused investor, Andy evolved to a more growth-oriented outlook—a result of some early research on the origins of the world’s biggest successes: When thumbing through the Forbes 400 list, looking for commonalities among the wealthiest Americans, Andy observed that the self-made on the list overwhelmingly had taken hold of a growing idea and stuck with it. To Andy, success rarely came from buying something cheaply, fixing it up and selling it for more. Rather, it was about finding the next big thing, being patient and riding its success over time—the early makings of a growth investor.

Andy chose mid caps as his starting universe. He found them to be an investing sweet spot—a compelling intersection of quality, competitively advantaged businesses with still-ample growth runways. Andy often says, “Mid cap is a state of mind”—a belief that remains embedded in the Growth team’s DNA. As Andy’s confidence in his process and his ability to repeat it successfully over time grew, he realized he needed a bigger platform. There were too many ideas for him to individually research. When Artisan Partners asked Andy to join the firm and build a research platform, he made the jump.

Andy arrived at Artisan Partners in 1997 with much of his investment philosophy and process in place—a security selection process that aimed to be right more often than wrong and a capital allocation process designed to be right in a bigger way than when wrong. Andy’s goal was finding companies with durable franchises, trading at reasonable valuations and with an accelerating profit cycle that Andy (and, later, his team) could identify and understand. Andy focused on profit cycles because of his belief that linear moves are rare—no company drives accelerating profit growth indefinitely. Rather, profits tend to cycle over time—the idea is to capture as much of that virtuous cycle as possible, and then eventually harvest the investment in favor of more compelling, earlier stage opportunities. In allocating capital, Andy looked to seed the portfolio with promising but as-yet unproven GardenSM holdings, growing them into CropSM holdings as their profit cycles matured as expected and finally moving them into HarvestSM holdings.

A sound philosophy and process weren’t enough. Andy set out to build a team with breadth of experience and depth of expertise—a team that shared his vision and could help Andy apply the process with discipline. Andy’s first hire was arguably his most important. When he first met Jim Hamel, Jim was a recent college graduate steadily working his way up at Kimberly-Clark. As Andy says, he was looking for someone to go to war with, not someone to go out and socialize with, and Jim’s background was the right one. In addition to an impressive resume, Jim had a work ethic and a focus on the practical, day-to-day application of Andy’s philosophy and process that complemented Andy’s own strengths.

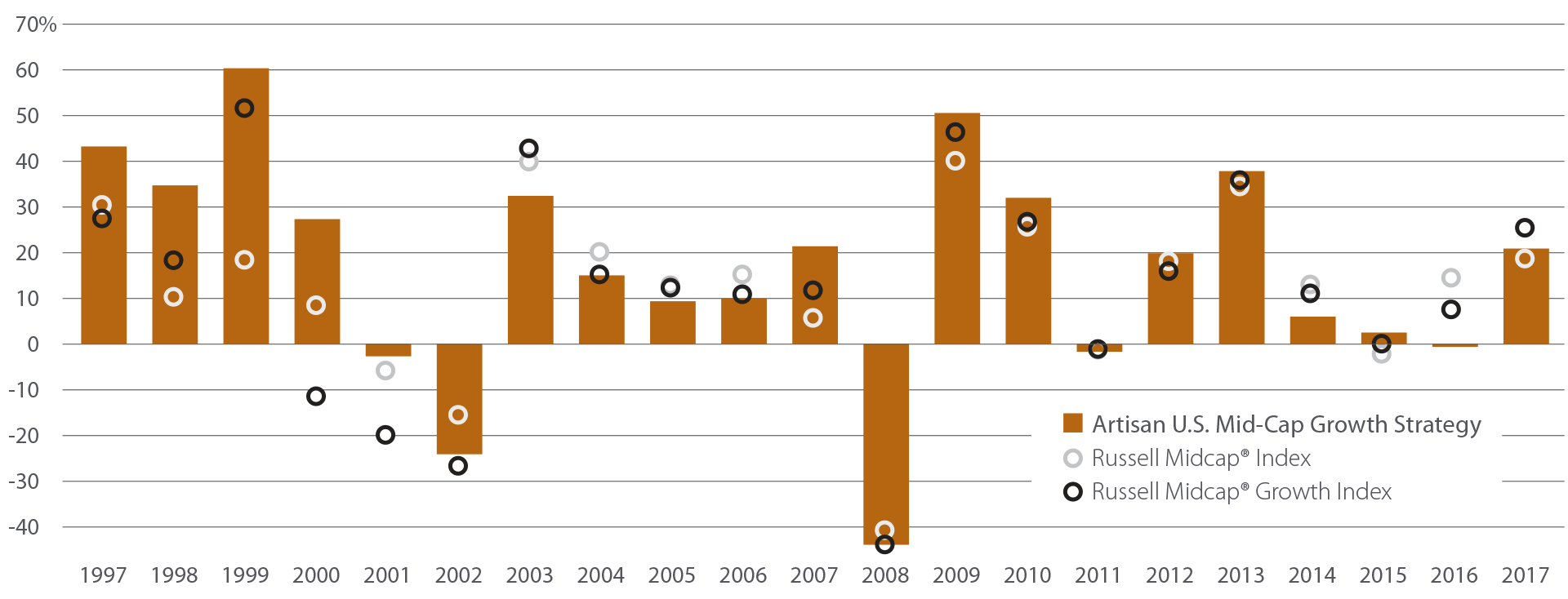

Andy’s and Jim’s early results spoke for themselves—even against the backdrop of the heady, late-TMT bull market days, Artisan Partners U.S. Mid-Cap Growth Strategy stood out. Andy was named the Barron’s/Value Line Fund Survey’s No. 1 overall fund manager in 2000. In 2002, Barron’s survey ranked Andy the No. 4 manager out of 217 in the growth fund category and the No. 9 overall fund manager out of 650. The team’s success didn’t go unnoticed, and asset flows accelerated.

Andy refers to investing as a scar-tissue business—investors have to learn from their mistakes and build upon experiences to improve. The bull market that kicked off in 2002 built some scar tissue around the Growth team’s process. As the team’s asset flows were increasing, the market turned in favor of materials and other cyclicals, and growth stocks fell out of favor. The market environment was more challenging for the Growth team’s process—a process which favored profit cycles based on identifiable factors rather than the vagaries of commodity prices. Added to those external factors was an internal one: The team itself was still a work in progress, regularly adding new members—which resulted in growing pains.

The net effect was disappointing relative performance results and a portfolio that lost focus. In looking back, Andy acknowledges this contravened a core belief—that one of the keys to long-term investing success is getting sufficient capital behind big ideas early enough in their profit cycles that the strategy benefits from that growth.

Andy describes this period as the best of times and the worst of times. The challenging period forced the team to look inward—they had to determine the extent to which the challenges were the result of their process, or a function of external factors. The team refined its approach, but also remained confident in its core beliefs and therefore patient in expectation of a more favorable market environment better suited to its approach. Andy and the Growth team emerged from this period having refined the process while believing in it more deeply than ever.

Sources: Artisan Partners/Russell as of December 31, 2017. 1997 period reflects the unannualized return from strategy inception on April 1 through year end. Strategy performance represents composite returns net of investment advisory fees.

Ultimately, the experience helped Andy and the team better identify what they did and didn’t want to own—sometimes owning the wrong things helps clarify what you do want to own. The team refocused energy on finding high-quality franchises on the cusp of compelling profit cycles—paring the portfolio and concentrating capital in the team’s highest conviction holdings.

One of the benefits of the Artisan model is it allows teams to seek clients whose investing time horizons align with a period over which an investment team’s philosophy and process can achieve success. Further, Andy notes it’s important to find clients who have the appropriate focus on people and process. He believes these are more critical to long-term success than performance results—which are inherently backward looking and whose replication in the future is impossible to guarantee. Without the people and process in place, it’s highly unlikely a team will be able to generate successful, long-term results—in turn diminishing the likelihood clients will meet their own longer term investing objectives.

This is why so much of Andy’s time with clients over the years focused on his investing philosophy, lessons learned, the security selection and capital allocation processes—and of course the team’s progress toward becoming capable decision-makers. One of Andy’s goals was ensuring clients’ fundamental understanding of the philosophy and process and how it would be consistently executed—which resulted in much of the language which has become so closely associated with the team.

These considerations were top of mind for Andy and Jim from the early days, and they set out to ensure their investment process was repeatable—and that they could teach it to multiple generations on the team. One aspect of Andy’s approach to building the team’s culture was creating a winning environment. As the Growth team matured, it found a way to develop new investors, learning over time how to identify individuals who could build substantial conviction in their recommendations—and communicate that effectively and persuasively to the team’s decision-makers—while simultaneously maintaining an appropriate level of emotional detachment from those recommendations. That ability to correctly identify and acknowledge when the facts just simply didn’t support an original thesis—“what is, is; what isn’t, isn’t”—was critical to the team’s ability to build repeatability into its process. As Andy says, “Pride is a killer.”

Investing, like baseball, is a business in which a difference of thousandths spread over the course of years can matter tremendously. The difference between a Hall of Fame hitter who bats .300 over the course of his 15-year career and the .275 hitter who lasts only a couple years is a matter of roughly one hit every couple weeks. Similarly, investing is less about the day-to-day results and much more about the steady accumulation of singles and doubles over the course of an investing career—an idea Andy drew from Michael Lewis’s Moneyball. As Andy and Jim were refining their approach to developing future investors, they found ways to apply measurement to individual analyst performance so the analysts could see for themselves how they were doing, but also so Andy and Jim wouldn’t allow recent successes (or failures) to color their evaluations.

Andy also created a clear career path for analysts. Yet another outcome of the challenging mid-2000s period was Andy’s recognition that moving to a multi-decision-maker model would allow the team to continue growing.

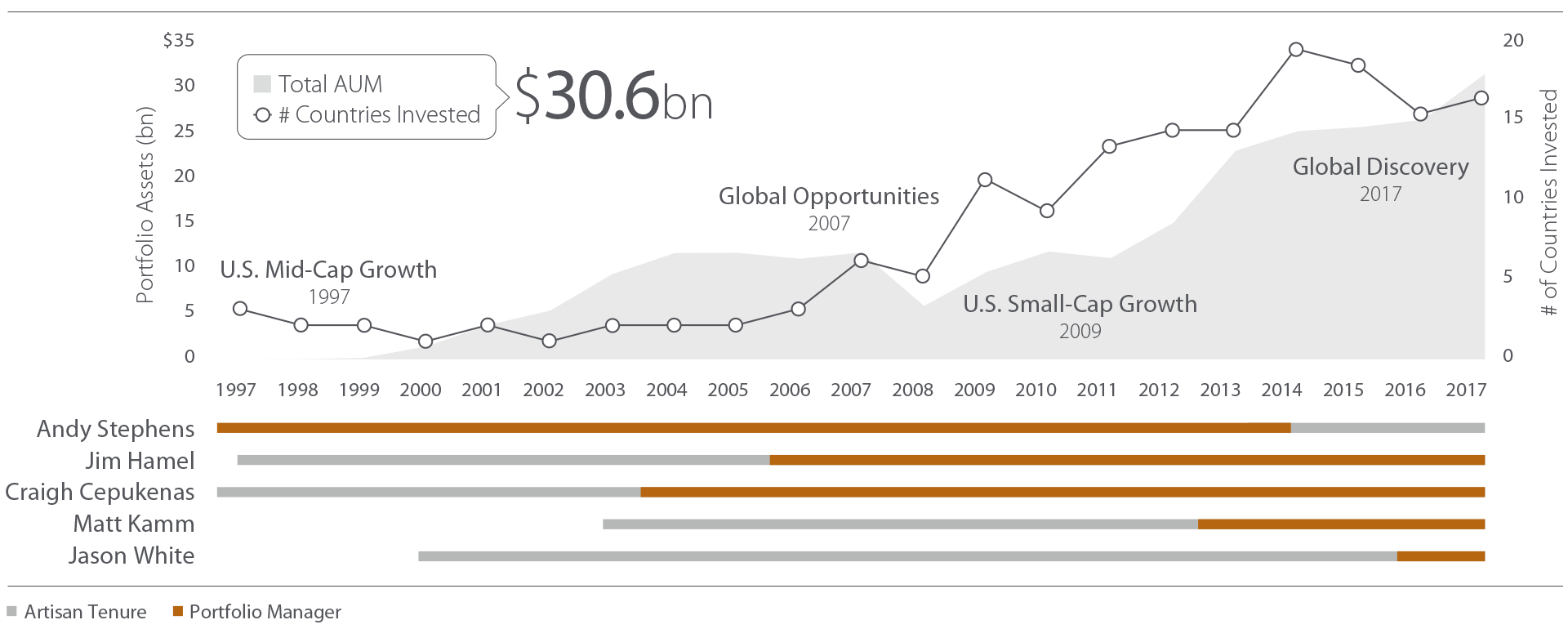

Consequently, Jim Hamel, who had started as an analyst, was named Associate Portfolio Manager in 2001 and Portfolio Manager in 2006. This transition had multiple positive impacts: Not only did it allow for the launch of new strategies—first, Global Opportunities in 2007—but it also modeled a path for the team’s analysts. Andy cites these factors as among the reasons for the Growth team analysts’ long tenures, which in turn foster broad and deep experience and the ability to consistently apply the philosophy and process, no matter who is currently at the helm.

With the team developing multigenerational talent, the next step was rounding out the research platform. Though the team started with mid caps, Andy’s vision was to build a platform that could find growth wherever growth was occurring—not where history and convention told them it should be. With the launch of Global Opportunities, the team was able to invest directly in franchises outside of the United States—franchises the team’s research was naturally leading them to anyway in an increasingly globalized economy. The team also found it often bumped into smaller investments—which didn’t naturally fit the team’s existing mid cap and global strategies but were important to follow as potential candidates down the road. In 2009, the Growth team thoughtfully absorbed Artisan’s existing U.S. Small-Cap Growth strategy, adding Craigh Cepukenas as a Growth team portfolio manager. The Growth team now had the opportunity to go anywhere in the world and anywhere along the market cap spectrum to find what it believed to be the most compelling growth opportunities available.

# of Countries Invested represents, as of December 31 of each year, the number of countries in the Growth team’s portfolios based on issuers’ MSCI country classification.

With the launch of the Global Discovery strategy in August 2017—a strategy Andy describes as “the one we would have started with if we could have”—the team has, in a way, come full circle. This latest strategy, of which Jason White is the lead portfolio manager, applies the “mid cap as a state of mind” philosophy to a highly unconstrained, global universe with greater size freedom than the existing portfolios.

What started two-plus decades ago—with Andy’s drive to build and his vision of a research platform more durable than any individual—is today an investment franchise managing assets for clients from the US to the UK to Australia and investing in accelerating profit cycles globally.

With a multigenerational franchise, a global, unconstrained research platform, and a team of highly capable analysts who have the philosophy and process deeply imbued in their DNA, Andy can check off all of his initial to-dos. He is confident that the next generation of Growth team investors will carry on the team’s time-tested philosophy and process and continue to generate successful outcomes for clients.