Dear clients, employees and shareholders of Artisan Partners,

In 2018, Artisan Partners signed the United Nations-supported Principles for Responsible Investment. The PRI network is working to achieve a more sustainable global financial system through responsible investing, good governance, integrity and accountability. PRI's mission and principles encourage a long-term, sustainable approach—both to investing and running a business.

That approach aligns well with our firm's focus on generating successful, long-term outcomes—for clients, employees and shareholders. We constantly repeat "long term" and remind our constituents that we are not solving for short periods. We believe that our clients have long-term investment horizons, our employees seek success over an entire career and our shareholders want us to grow business value and generate a healthy regular return.

Still, we understand that without more detail, "long term" and "sustainable" are vague and open-ended terms. Different firms have different time horizons for measuring success. And sustainable practices can (and indeed, should) take different forms at different firms—complementing and enhancing a firm's competitive and strategic edge.

Therefore, we think it's important to be transparent about what sustainability means to us and what we are trying to accomplish:

We believe there are three key elements for generating sustainable outcomes along each of these dimensions. First, we must have a commercial and social purpose that is meaningful and enduring. Second, we need a business model that matches our purpose and gives us an edge. Third, we must deliver results that validate our approach and build trust—high value-added investment outcomes for clients, successful careers for employees and financial returns for shareholders.

At Artisan Partners, our purpose—the reason our firm exists—is to generate and compound wealth over the long term for our clients. We have a long history of compounding wealth and adding value, net of fees. The wealth we generate for clients improves retirement outcomes, pays for education, funds charitable purposes and, in general, improves people's lives. We are proud of our track record for clients, and we are dedicated to continuing and improving it.

One area we have impacted—and can continue to impact—is the retirement space. It is estimated that approximately 50% of American households will not have enough retirement income to maintain their pre-retirement standards of living. We believe that high value-added investing should be part of the solution to this problem.

Our 9 investment strategies with track records of at least 10 years have, on average, outperformed their broad-based benchmarks by 2.37% per year, net of fees, since inception. That alpha represents significant additional wealth for our clients, after fees. We have generated those results across multiple autonomous investment teams, generations of talent, investment styles and asset classes. The constant has been the Artisan Partners business model and our process for identifying, recruiting and partnering with investment talent. We have demonstrated that what we do is repeatable.

Nevertheless, we have experienced first-hand the ongoing trend to allocate retirement savings to low-fee, market-cap-weighted index strategies. The trend is especially prevalent in the defined contribution space where plan fiduciaries face legal pressure to minimize fees at all cost. The single-minded focus on fee minimization can result in significant foregone wealth for retirees. We believe that the entire financial services industry should focus less on price and more on value, i.e., net-of-fee outcomes over relevant (long-term) time horizons.

We remain focused on providing current and future retirees with access to our services through retirement plans, intermediaries and directly. Today, approximately 25% of our AUM is managed on behalf of retirement plans. Over the last five years, we have been pleased to add eight Australian retirement plans as clients for whom we manage over $3 billion on behalf of millions of plan beneficiaries.

Through all our investment mandates, what we do matters to people's lives. That's a huge responsibility—and a wonderful opportunity. Our purpose is to serve these people by generating and compounding wealth for them over the long term.

We are confident that we will continue to successfully fulfill that purpose because of the combination of our talent and our model. We believe that our firm is the ideal home for passionate and independent thinkers who want to build investment franchises and own the outcomes—with as few distractions as possible.

The priority we place on investments and talent permeates our firm. Each investment team has complete autonomy over its investment process and decision-making. The environment in which each team operates is unique and individually tailored. Each team is built and resourced—and eventually evolves—in the way that works best for the team. Within each investment team, our model creates an ownership mindset marked by dedication, attention to detail, long-termism, integrity, accountability, economic alignment and pride—in short, both skin and soul in the game.

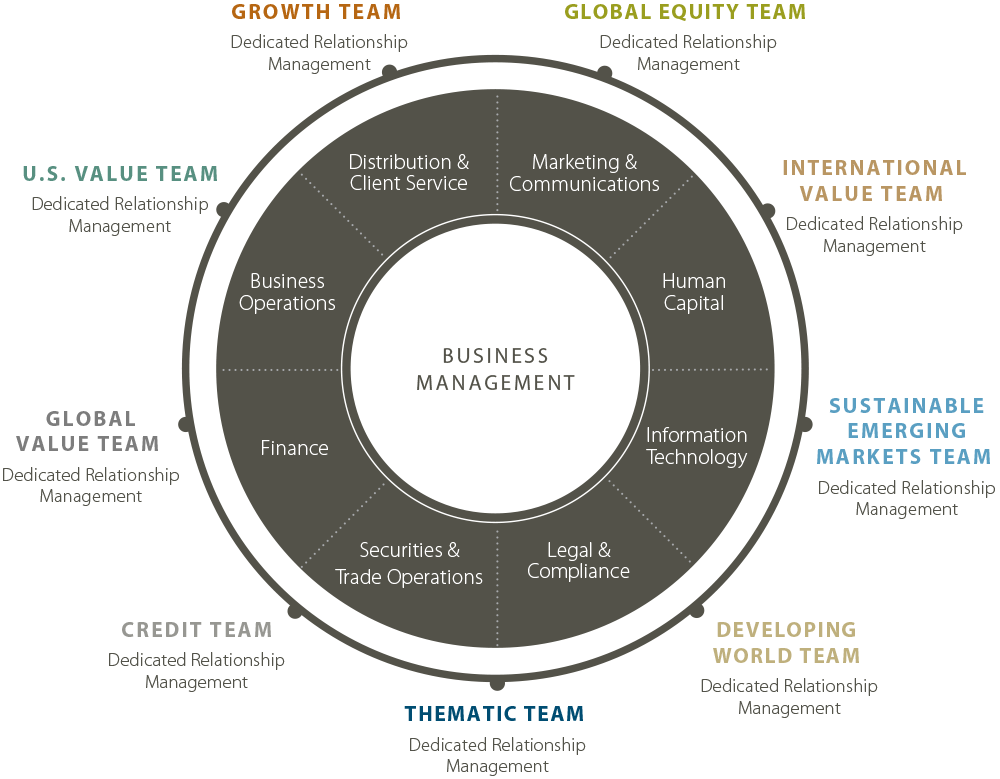

While our model is designed for and around investment talent, executing the model requires talented people across our entire firm. This includes distribution professionals who can serve clients across multiple channels with minimal distractions for investment team members. And business management and operations professionals who can successfully support nine distinct investment franchises, each with its own unique needs and culture.

Every Artisan employee plays an important role in delivering for our clients, and I am regularly impressed (though not surprised) with the extent to which employees across our firm are committed to distraction-free investing and successful and sustainable results for clients.

We have designed our capital structure to complement and enhance our business model. As a human capital business, it is critically important that we align the long-term economics of our key leaders and emerging talent with those of our clients and shareholders—and that we do so in a way that is sustainable over time. Our public listing in 2013 provided a transparent and easy-to-value currency for equity awards going forward and a structured and non-disruptive mechanism for senior and retiring leaders to liquidate prior awards.

Since going public, we have continued to grant equity awards in a unique and differentiated way. Approximately 90% of each year's awards are made to investment team members. And approximately 50% of the awards do not vest until the recipient's retirement (with substantial advance notice) from Artisan Partners. This is one example of how we have married the enhanced transparency and liquidity of a publicly listed company with the discipline and long-term orientation that have always guided us.

Not everyone agrees with our differentiated approach. For example, Institutional Shareholder Services would prefer that we grant relatively more equity to our executive officers (reducing the amount available for investment team members), and ISS gives us little credit for the long-duration alignment created by our career vesting terms. In response, we could change our approach and improve our standing with ISS. But doing so would sacrifice important elements of Who We Are as a firm that we believe are important to long-term success.

We are comfortable with the resulting friction. It is a natural consequence of being a publicly listed company and a reasonable price to pay for the benefits: better governance, more transparency, increased economic alignment and more efficient liquidity. In general, our public listing has made us a more sustainable firm—something that I believe is true for most publicly listed firms, as better governance and greater transparency alone render them more sustainable than privately held competitors.

The best proof points for our model and approach are our long-term results. Purpose and plans are not enough. As a firm, we must deliver for our clients, employees and shareholders. We have a track record of doing so.

Net of fees, all 15 of our publicly available investment strategies have compounded wealth for clients since inception. Equally important, we have operated each strategy with integrity: Our investment teams have invested as they said they would.

| 1 Yr | 3 Yr | 5 Yr | Inception | |

|---|---|---|---|---|

| Artisan U.S. Small-Cap Growth—1-Apr-95 | 17.22 | 21.90 | 11.18 | 10.03 |

| Artisan Non-U.S. Growth—1-Jan-96 | -1.44 | 6.81 | 2.73 | 8.92 |

| Artisan U.S. Mid-Cap Growth—1-Apr-97 | 13.02 | 14.27 | 8.33 | 13.98 |

| Artisan U.S. Mid-Cap Value—1-Apr-99 | -0.66 | 8.08 | 3.91 | 11.46 |

| Artisan Non-U.S. Value—1-Jul-02 | -3.72 | 6.64 | 3.67 | 10.56 |

| Artisan Value Equity—1-Jul-05 | 1.63 | 10.36 | 6.29 | 7.15 |

| Artisan Sustainable Emerging Markets—1-Jul-06 | -7.65 | 12.79 | 5.56 | 4.71 |

| Artisan Global Opportunities—1-Feb-07 | 3.24 | 13.78 | 10.23 | 9.55 |

| Artisan Global Value—1-Jul-07 | -0.86 | 8.92 | 5.70 | 7.17 |

| Artisan Global Equity—1-Apr-10 | 6.10 | 14.74 | 8.47 | 11.43 |

| Artisan High Income—1-Apr-14 | 4.63 | 9.18 | 6.35 | 6.35 |

| Artisan Developing World—1-Jul-15 | 3.81 | 14.51 | 9.04 | |

| Artisan Thematic—1-May-17 | 17.44 | 28.49 | ||

| Artisan Global Discovery—1-Sep-17 | 10.00 | 13.31 | ||

| Artisan Non-U.S. Small-Mid Growth—1-Jan-19* | 15.34 |

*Returns for periods less than one year are not annualized.

Data as of and through March 31, 2019. Source: Artisan Partners. Average Annual Total Returns presents composite (net of fees) performance for each strategy. Performance for Artisan Thematic Long/Short and Credit Opportunities Strategies has been intentionally omitted. Past performance is not indicative of future results. See Disclosures for more information about our investment performance.

In addition to compounding wealth on an absolute basis, 13 of the 15 strategies have generated meaningful outperformance relative to their respective broad-based benchmarks since inception, representing significant additional wealth for clients. Our 9 investment strategies with track records of at least 10 years have, on average, outperformed their broad-based benchmarks by 2.37% per year, net of fees, since inception.

| 1 Yr | 3 Yr | 5 Yr | Inception | |

|---|---|---|---|---|

| Artisan U.S. Small-Cap Growth—1-Apr-95 | 15.17 | 8.98 | 4.13 | 0.90 |

| Artisan Non-U.S. Growth—1-Jan-96 | 2.27 | -0.46 | 0.41 | 4.32 |

| Artisan U.S. Mid-Cap Growth—1-Apr-97 | 6.55 | 2.45 | -0.47 | 3.78 |

| Artisan U.S. Mid-Cap Value—1-Apr-99 | -7.13 | -3.74 | -4.90 | 2.14 |

| Artisan Non-U.S. Value—1-Jul-02 | 0.00 | -0.63 | 1.34 | 4.67 |

| Artisan Value Equity—1-Jul-05 | -7.67 | -3.16 | -4.34 | -1.70 |

| Artisan Sustainable Emerging Markets—1-Jul-06 | -0.24 | 2.11 | 1.88 | -0.48 |

| Artisan Global Opportunities—1-Feb-07 | 0.64 | 3.11 | 3.78 | 4.75 |

| Artisan Global Value—1-Jul-07 | -3.46 | -1.75 | -0.75 | 2.94 |

| Artisan Global Equity—1-Apr-10 | 3.49 | 4.07 | 2.02 | 3.46 |

| Artisan High Income—1-Apr-14 | -1.31 | 0.50 | 1.66 | 1.66 |

| Artisan Developing World—1-Jul-15 | 11.22 | 3.83 | 4.42 | |

| Artisan Thematic—1-May-17 | 7.95 | 16.83 | ||

| Artisan Global Discovery—1-Sep-17 | 7.40 | 7.39 | ||

| Artisan Non-U.S. Small-Mid Growth—1-Jan-19* | 5.09 |

*Returns for periods less than one year are not annualized.

Data as of and through March 31, 2019. Source: Artisan Partners/MSCI/Russell/ICE BofA Merrill Lynch/S&P. Value Added Average Annual Total Returns is based on the composite (net of fees) performance minus the returns of the broad-based benchmark. Performance for Artisan Thematic Long/Short and Credit Opportunities Strategies has been intentionally omitted. Past performance is not indicative of future results. See Disclosures for more information about our investment performance and benchmarks used.

We have launched nine investment teams. We have merged one team into another team and evolved one team into two teams. We have never shuttered a team. We actively work with each team to develop the traits of a sustainable investment franchise: recognizable leadership, a grounded investment philosophy and process, proven results, depth and breadth of resources, economic alignment, a unique culture and a distinctive brand.

In 2018, we recruited, onboarded and resourced Rezo Kanovich, a well-known and successful investor. We also evolved our Global Value team into two separate and autonomous investment franchises in order to increase the probability of long-term, sustainable success for our clients and our talent. In addition to these changes, we recently promoted portfolio managers on our Growth and U.S. Value teams. Today, five of our nine investment teams have portfolio managers from multiple generations.

As a human capital business, we focus on the environment we create for our investment teams and employees, long-term economic alignment and employee benefits. We try to avoid generic "check-the-box" solutions and instead favor a tailored approach in keeping with our pursuit of great talent and differentiated outcomes. Some examples of what we do to promote success across a diverse group of employees are:

For additional information on these and other sustainability topics, view our Sustainability/ESG Report.

Since our IPO in March 2013, we have grown our business value by launching three new investment teams, recruiting five industry-proven portfolio managers, launching seven new investment strategies, increasing investment degrees of freedom, and expanding and strengthening our distribution reach and operational capabilities. We have reinvested a total of $342.1 million in our employees in the form of equity awards, with approximately 90% of the awards going to our investment talent.

We have made those investments while maintaining a healthy margin and distributing significant cash to our shareholders. In 2018, our operating margin (which includes the impact of the investments described above) was 36.8%. Since the March 2013 IPO, we have made a total of $1.7 billion in cash distributions and dividends to our owners, which represents an annual cash return of approximately 11% based on our market capitalization at the time of our IPO.

Our purpose, our business model and our results provide a strong foundation for sustained success. Today, we are more capable and more diversified than ever before. Our investment teams have stable talent and strong track records. We have investment capacity in multiple strategies in asset classes that we expect will grow over time.

We will continue to develop our investment franchises and selectively add new talent, teams and strategies to further differentiate our firm. We are navigating the evolving distribution landscape, including changes in asset-allocator and owner preferences, digitization, investment vehicles and the continued growth of the private wealth channel across the world.

In addition, consistent with our undertakings as a PRI signatory, we will continue to evolve our approach to sustainability across the firm, including the sustainability and ESG resources available to our investment teams and our disclosures about these topics.

We are excited about our future and look forward to delivering results for clients, employees and shareholders long into the future. We appreciate your support, and we value the trust you place in us.

Sincerely,

Eric Colson

Chief Executive Officer

Artisan Partners