- Investor Update—Q1 2024

- Artisan Partners Developing World Team Portfolio Manager Lewis Kaufman discusses his team’s investment philosophy, portfolio positioning and the current market environment.

- Listen Now

The investment team seeks to build, preserve and enhance a stream of compounded business value. It defines this emphasis as follows:

Build

Pair low penetration domestic demand with scalable and enduring businesses that are able to drive value creation and disproportionate outcomes.

Preserve

Preserve value creation and establish a forward-looking construct for managing risk.

Enhance

Leverage value pathways to enhance long-term value creation.

| As of 30 June 2024 | QTD | YTD | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Inception |

|---|---|---|---|---|---|---|---|

| Composite — Gross | 5.05 | 17.02 | 22.12 | -8.18 | 10.70 | — | 10.97 |

| Composite — Net | 4.78 | 16.43 | 20.86 | -9.15 | 9.55 | — | 9.82 |

| MSCI Emerging Markets Index | 5.00 | 7.49 | 12.55 | -5.06 | 3.09 | — | 3.71 |

| As of 30 June 2024 | QTD | YTD | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Inception |

|---|---|---|---|---|---|---|---|

| Composite — Gross | 5.05 | 17.02 | 22.12 | -8.18 | 10.70 | — | 10.97 |

| Composite — Net | 4.78 | 16.43 | 20.86 | -9.15 | 9.55 | — | 9.82 |

| MSCI Emerging Markets Index | 5.00 | 7.49 | 12.55 | -5.06 | 3.09 | — | 3.71 |

| Trailing 12 Months Ended 30 June | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Composite — Gross | 39.32 | 54.28 | -48.02 | 21.91 | 22.12 |

| Composite — Net | 37.90 | 52.72 | -48.59 | 20.65 | 20.86 |

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

|

|||||

| Composite — Gross | 43.40 | 83.46 | -8.71 | -40.56 | 30.96 |

| Composite — Net | 41.94 | 81.64 | -9.68 | -41.21 | 29.62 |

| MSCI Emerging Markets Index | 18.42 | 18.31 | -2.54 | -20.09 | 9.83 |

| As of 30 June 2024 | Average Up Month | Average Down Month |

| Composite — Net | 443bps | -376bps |

| MSCI Emerging Markets Index | 381bps | -407bps |

| Difference | +62bps | +31bps |

Based on monthly net-of-fees composite returns beginning July 1, 2015. Net-of-fees composite returns were calculated using the highest model investment advisory fees applicable to portfolios within the composite. Upside/Downside Capture represents average monthly returns during months when the index was positive and negative, respectively.

|

Top 10 Holdings (% of total portfolio as of 30 June 2024) |

|

|---|---|

| MercadoLibre Inc (Argentina) | 6.0 |

| MakeMyTrip Ltd (India) | 5.9 |

| Sea Ltd (Singapore) | 5.7 |

| NVIDIA Corp (United States) | 4.8 |

| NU Holdings Ltd (Brazil) | 4.7 |

| Airbnb Inc (United States) | 4.6 |

| Adyen NV (Netherlands) | 4.6 |

| Visa Inc (United States) | 4.6 |

| Crowdstrike Holdings Inc (United States) | 4.4 |

| Meituan (China) | 3.5 |

| Total | 48.8% |

|

Portfolio Statistics (as of 30 June 2024) |

|

|---|---|

| Median Market Cap (Billions) | $83.3 |

| Weighted Avg. Market Cap (Billions) | $286.1 |

| Number of Securities | 32 |

| Number of Countries | 9 |

| Cash (% of total portfolio) | 2.5% |

|

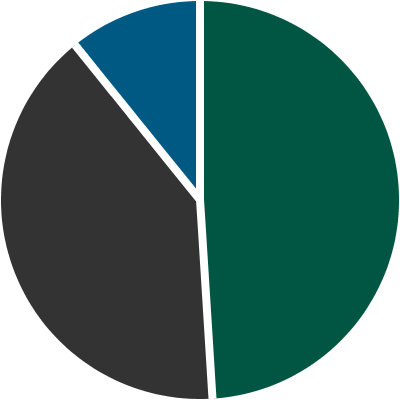

Region Allocation (% of portfolio securities as of 30 June 2024) |

|

|---|---|

|

|

| Developed Markets | 48.7 |

| Asia | 40.3 |

| Latin America | 10.9 |

| Total | 100.0% |

|

Top 10 Countries (% of portfolio securities as of 30 June 2024) |

|

|---|---|

| United States | 35.3 |

| China | 16.7 |

| India | 14.4 |

| Singapore | 9.2 |

| Netherlands | 7.9 |

| Argentina | 6.1 |

| Brazil | 4.8 |

| France | 4.3 |

| Australia | 1.3 |