Fixed income securities carry interest rate risk and credit risk for both the issuer and counterparty and investors may lose principal value. In general, when interest rates rise, fixed income values fall. High income securities (junk bonds) are speculative, experience greater price volatility and have a higher degree of credit and liquidity risk than bonds with a higher credit rating. The portfolio typically invests a significant portion of its assets in lower-rated high income securities (e.g., CCC). Loans carry risks including insolvency of the borrower, lending bank or other intermediary. Loans may be secured, unsecured, or not fully collateralized, trade infrequently, experience delayed settlement, and be subject to resale restrictions. Private placement and restricted securities may not be easily sold due to resale restrictions and are more difficult to value. Use of derivatives may create investment leverage and increase the likelihood of volatility and risk of loss in excess of the amount invested. International investments involve special risks, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging and less developed markets, including frontier markets. The costs associated with an investment will impact your return over time. These risks, among others, are further described in Artisan Partners Form ADV, which is available upon request.

Unless otherwise indicated, strategy characteristics relate to that of a representative account managed within the investment composite. It is intended to provide a general illustration of the investment strategy and considerations used by Artisan Partners in managing that strategy. Individual accounts managed to the strategy may differ, at times significantly, from the reference data shown due to varying account restrictions, fees and expenses, and longevity periods, among others. Where applicable, this information is supplemental to, and not to be construed with, a current or prospective client's investment account information.

Performance Source: Artisan Partners/ICE BofA.

Net-of-fees composite returns were calculated using the highest model investment advisory fees applicable to portfolios within the composite. Fees may be higher for certain pooled vehicles and the composite may include accounts with performance-based fees. All performance results are net of commissions and transaction costs, and have been presented gross and net of investment advisory fees. Dividend income is recorded net of foreign withholding taxes on ex-dividend date or as soon after the ex-dividend date as the information becomes available to Artisan Partners. Interest income is recorded on the accrual basis. Performance results for the Index include reinvested dividends and are presented net of foreign withholding taxes but, unlike the portfolio's returns, do not reflect the payment of sales commissions or other expenses incurred in the purchase or sale of the securities included in the indices.

Data & Statistics Sources: Artisan Partners/Bloomberg. Unless otherwise indicated, percentages shown are of total fixed income securities in the portfolio. Portfolio statistics are intended to provide a general view of the entire portfolio, or Index, at a certain point in time and are calculated using information obtained from various data sources. Portfolio statistics include accrued interest unless otherwise stated. Artisan Partners may exclude outlier data and certain securities which lack applicable attributes, such as private securities when calculating portfolio statistics. If information is unavailable for a particular security Artisan may use data from a related security to calculate portfolio statistics. Unless otherwise noted, portfolio statistics represent the weighted average of the portfolio’s fixed-income securities and exclude cash and cash equivalents. Securities of the same issuer are aggregated to determine a holding’s weight in the portfolio. Totals may not sum due to rounding.

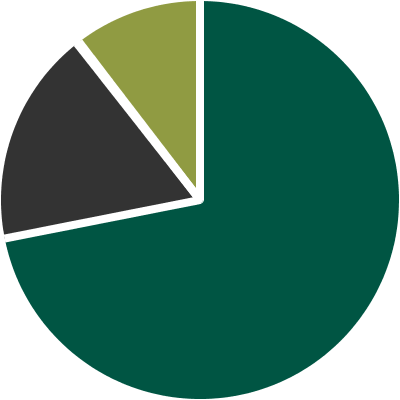

Credit Quality ratings are determined by Artisan Partners based on ratings from S&P and/or Moody's, which typically range from AAA (highest) to D (lowest). For securities rated by both S&P and Moody's, the higher of the two ratings was used, and those not rated by either agency have been categorized as Unrated/Not Rated. Ratings are applicable to the underlying portfolio securities, but not the portfolio itself, and are subject to change.

Maturity Distribution represents the weighted average of the maturity dates of the securities held in the Portfolio.

Free Cash Flow is a measure of financial performance calculated as operating cash flow minus capital expenditures.

Treasury futures represented net notional exposure of 0.00% of net assets.

ICE BofA US High Yield Index measures the performance of below investment grade $US-denominated corporate bonds publicly issued in the US market. The index(es) are unmanaged; include net reinvested dividends; do not reflect fees or expenses; and are not available for direct investment.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and, along with the ICE BofA trademarks, has been licensed for use by Artisan Partners Limited Partnership. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See

www.artisanpartners.com/ice-data.html for a full copy of the Disclaimer.