Non-diversified portfolios may invest larger portions of assets in securities of a smaller number of issuers and performance of a single issuer may have greater impact to the portfolio's returns. International investments involve special risks, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging and less developed markets, including frontier markets. Such risks include new and rapidly changing political and economic structures, which may cause instability; underdeveloped securities markets; and higher likelihood of high levels of inflation, deflation or currency devaluations. Securities of small- and medium-sized companies tend to have a shorter history of operations, be more volatile and less liquid and may have underperformed securities of large companies during some periods. The costs associated with an investment will impact your return over time. These risks, among others, are further described in Artisan Partners Form ADV, which is available upon request.

Assets under management include approximately $65 million (reported on a one-month lag) for which Artisan Partners provides investment models to managed account sponsors.

Unless otherwise indicated, strategy characteristics relate to that of a representative account managed within the investment composite. It is intended to provide a general illustration of the investment strategy and considerations used by Artisan Partners in managing that strategy. Individual accounts managed to the strategy may differ, at times significantly, from the reference data shown due to varying account restrictions, fees and expenses, and longevity periods, among others. Where applicable, this information is supplemental to, and not to be construed with, a current or prospective client's investment account information.

Performance Source: Artisan Partners/MSCI. Net-of-fees composite returns were calculated using the highest model investment advisory fees applicable to portfolios within the composite. Fees may be higher for certain pooled vehicles and the composite may include accounts with performance-based fees. All performance results are net of commissions and transaction costs, and have been presented gross and net of investment advisory fees. Dividend income is recorded net of foreign withholding taxes on ex-dividend date or as soon after the ex-dividend date as the information becomes available to Artisan Partners. Interest income is recorded on the accrual basis. Performance results for the Index include reinvested dividends and are presented net of foreign withholding taxes but, unlike the portfolio's returns, do not reflect the payment of sales commissions or other expenses incurred in the purchase or sale of the securities included in the indices.

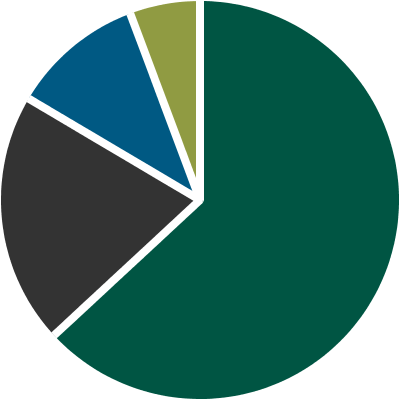

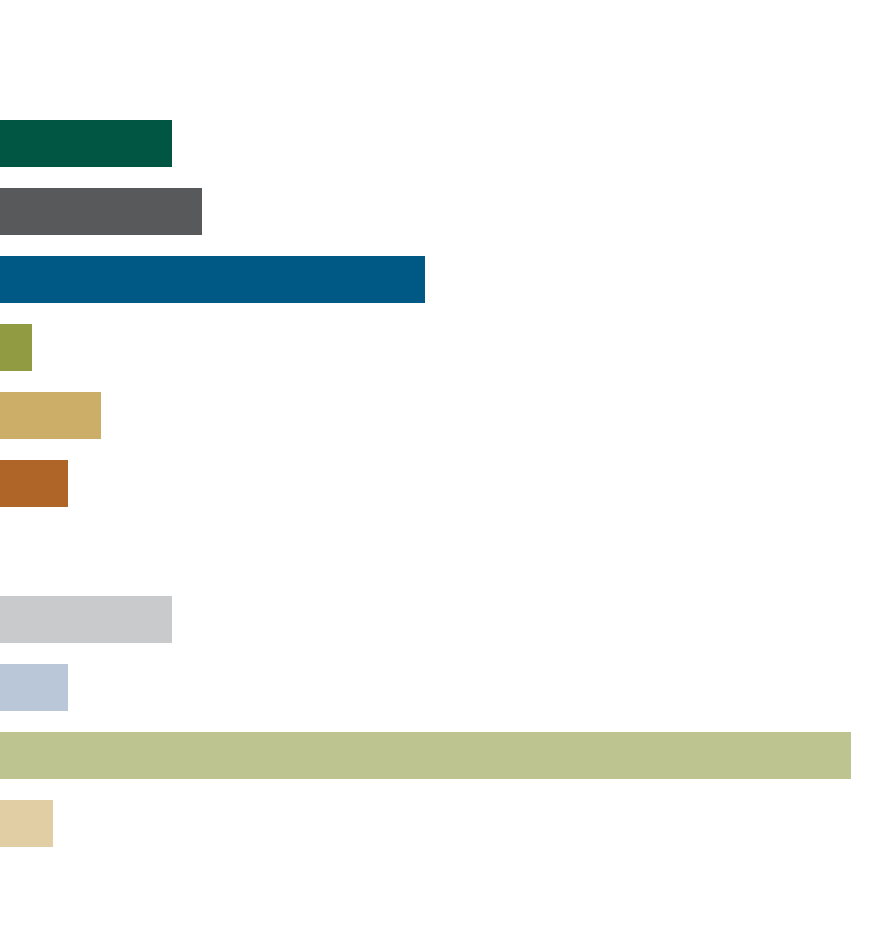

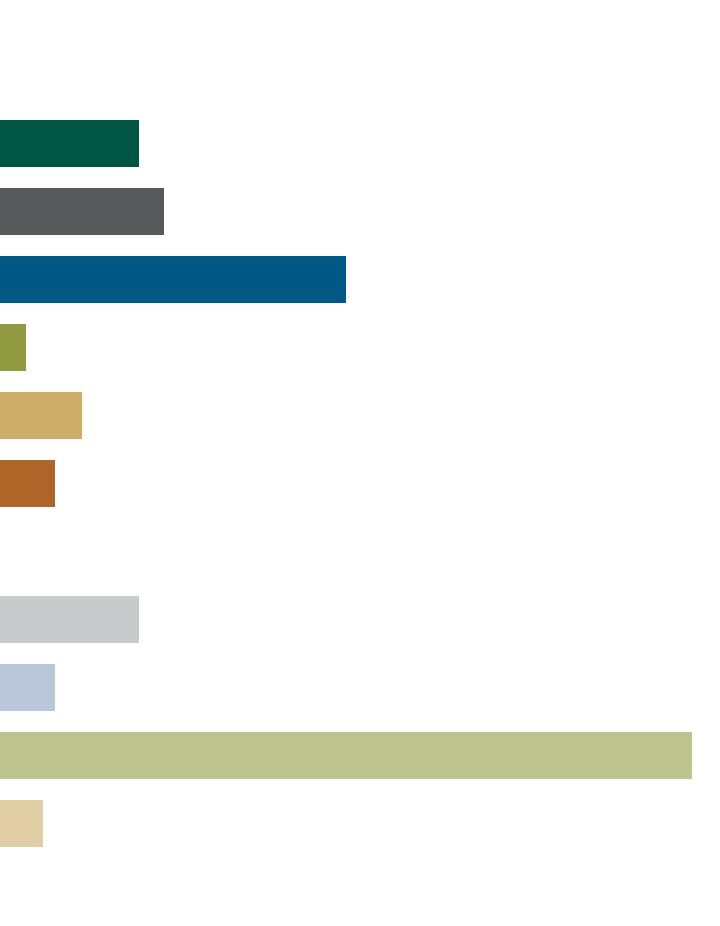

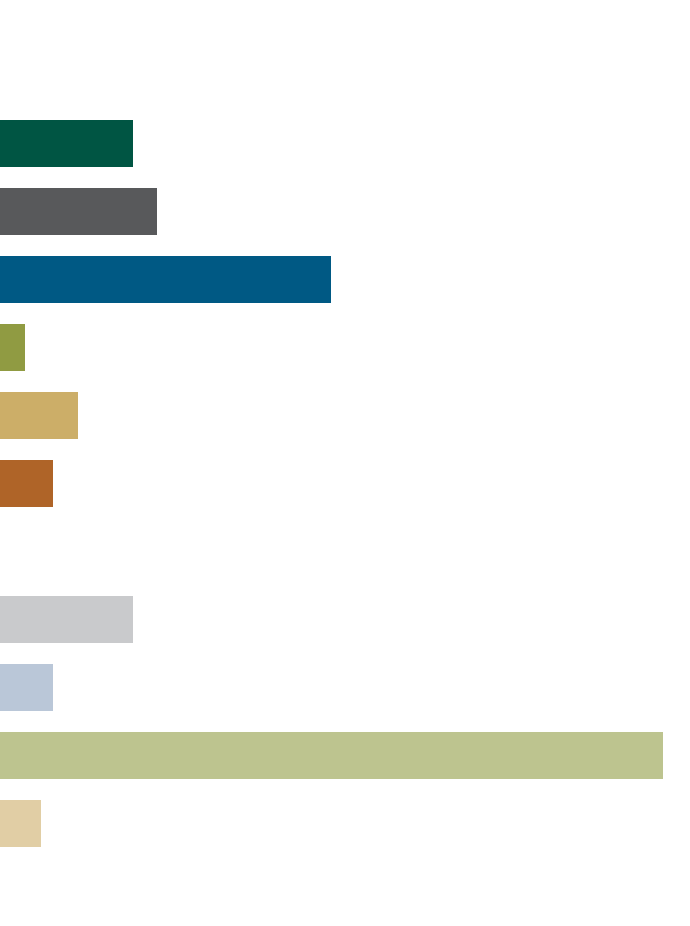

Sector Source: SASB. Sector exposure percentages reflect sector designations as currently classified by SICS. Country Classification Source: Artisan Partners. Portfolio country classifications are defined by the investment team and may differ substantially from MSCI classifications. Upon request, Artisan Partners will provide the portfolio’s country breakdown according to MSCI methodology. Data & Statistics Sources: Artisan Partners/MSCI. Annual turnover is reported as of the strategy’s fiscal year end. Artisan Partners may exclude outlier data and certain securities which lack applicable attributes, such as private securities when calculating portfolio statistics. If information is unavailable for a particular security Artisan may use data from a related security to calculate portfolio statistics. Securities of the same issuer are aggregated to determine a holding’s weight in the portfolio. Cash weighting includes cash and cash equivalents. Totals may not sum due to rounding.

Median is the data's midpoint value. Market Cap (USD) is the aggregate value of all of a company's outstanding equity securities. Market Capitalization up to $2 billion. Weighted Average is the average of values weighted to the data set's composition. Weighted Harmonic Average is a calculation of weighted average commonly used for rates or ratios. Price-to-Earnings Ratio (P/E Ratio) measures how expensive a stock is. Earnings figures used for FY1 and FY2 are estimates for the current and next unreported fiscal years. LT EPS Growth Rate is the average of the 3-5 year forecasted EPS growth rate of a company. Return on Equity (ROE) is a profitability ratio that measures the amount of net income returned as a percentage of shareholders equity. Annual Turnover is a measure of the trading activity in an investment portfolio—how often securities are bought and sold by a portfolio.

MSCI Emerging Markets Index measures the performance of emerging markets. The index(es) are unmanaged; include net reinvested dividends; do not reflect fees or expenses; and are not available for direct investment.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

The Sustainable Industry Classification System (SICS®) is the exclusive intellectual property of Sustainability Accounting Standards Board (SASB). SICS is intended to group companies based on their shared sustainability-related risks and opportunities.