- About Us

- Investments

- Performance

-

News & Insights

- News

- Thought Leadership

- Research & Data

- Advanced Document Filtering

- Resources

- Account Management

- Contact

- Corporate Home

The investment team seeks to invest in cash-producing businesses in strong financial condition that are selling at undemanding valuations.

| As of 30 June 2024 | QTD | YTD | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Inception |

|---|---|---|---|---|---|---|---|

| Advisor Class: APDLX | -2.36 | 6.15 | 13.90 | 7.55 | 12.72 | 9.12 | 8.32 |

| Russell 1000® Value Index | -2.17 | 6.62 | 13.06 | 5.52 | 9.01 | 8.23 | 7.48 |

| Russell 1000® Index | 3.57 | 14.24 | 23.88 | 8.74 | 14.61 | 12.51 | 10.26 |

| As of 30 June 2024 | QTD | YTD | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Inception |

|---|---|---|---|---|---|---|---|

| Advisor Class: APDLX | -2.36 | 6.15 | 13.90 | 7.55 | 12.72 | 9.12 | 8.32 |

| Russell 1000® Value Index | -2.17 | 6.62 | 13.06 | 5.52 | 9.01 | 8.23 | 7.48 |

| Russell 1000® Index | 3.57 | 14.24 | 23.88 | 8.74 | 14.61 | 12.51 | 10.26 |

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

|

|||||

| Advisor Class: APDLX | 30.38 | 10.91 | 23.25 | -8.67 | 24.32 |

| Russell 1000® Value Index | 26.54 | 2.80 | 25.16 | -7.54 | 11.46 |

| Russell 1000® Index | 31.43 | 20.96 | 26.45 | -19.13 | 26.53 |

| Gross | Net | |

| Semi-Annual Report 31 March 2024 | 0.96% | 0.88% |

| Prospectus 30 September 2023 | 0.97% | 0.88% |

Net expenses reflect a contractual expense limitation agreement in effect through 31 Jan 2025. See prospectus for further details. Semi-Annual Report Figure(s): Unaudited, annualized for the six-month period.

|

Top 10 Holdings (% of total portfolio as of 30 June 2024) |

|

|---|---|

| Alphabet Inc (Communication Services) | 4.1 |

| Meta Platforms Inc (Communication Services) | 3.9 |

| The Goldman Sachs Group Inc (Financials) | 3.2 |

| Humana Inc (Health Care) | 3.0 |

| Arch Capital Group Ltd (Financials) | 3.0 |

| Diageo PLC (Consumer Staples) | 2.9 |

| EOG Resources Inc (Energy) | 2.8 |

| Comcast Corp (Communication Services) | 2.8 |

| Kerry Group PLC (Consumer Staples) | 2.7 |

| Heineken Holding NV (Consumer Staples) | 2.7 |

| Total | 31.0% |

|

Portfolio Statistics (as of 30 June 2024) |

|

|---|---|

| Median Market Cap (Billions) | $76.0 |

| Weighted Avg. Market Cap (Billions) | $264.6 |

| Weighted Harmonic Avg. P/E (FY1) | 15.7X |

| Weighted Harmonic Avg. P/E (FY2) | 14.0X |

| Median Price/Book Value | 2.6X |

| Median ROE | 15.8% |

| Median Fixed Charge Coverage Ratio | 7.9X |

| Active Share | 86.8% |

| Annual Turnover | 38.1% |

| Number of Securities | 42 |

| Cash (% of total portfolio) | 4.2% |

| Non U.S. Equities (% of total portfolio) | 18.4% |

|

Market Cap Distribution (% of portfolio securities as of 30 June 2024) $ in billions |

|

|---|---|

| 204.0+ | 18.6 |

| 114.0–204.0 | 20.8 |

| 50.0–114.0 | 38.5 |

| 21.0–50.0 | 16.9 |

| 0.0–21.0 | 5.2 |

| TOTAL | 100.0% |

|

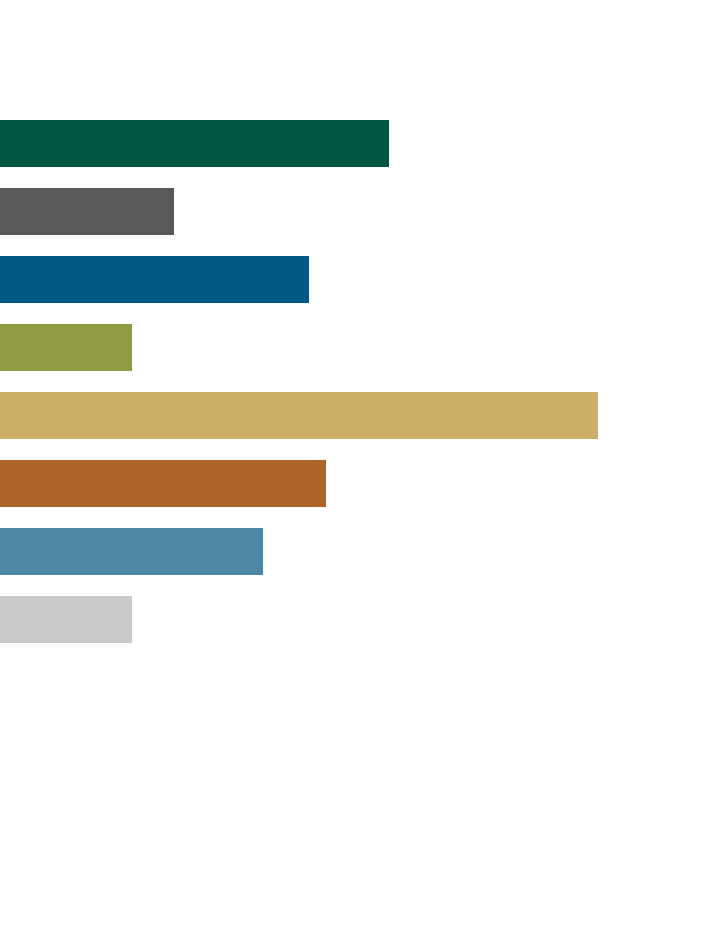

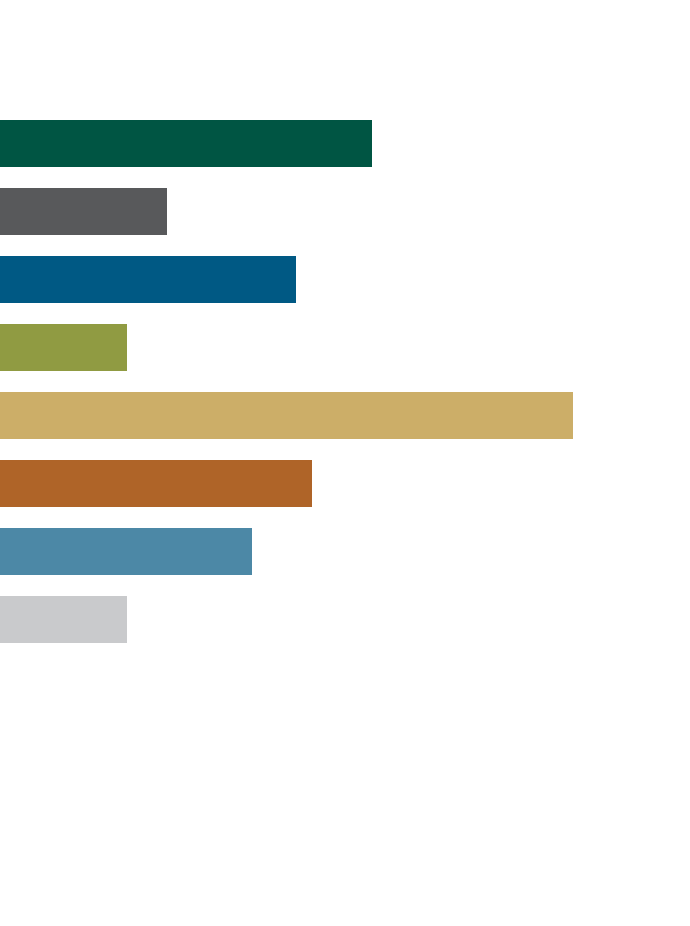

Sector Diversification (% of portfolio securities as of 30 June 2024) |

|

|---|---|

| Communication Services | 15.5 |

| Consumer Discretionary | 6.5 |

| Consumer Staples | 14.9 |

| Energy | 5.4 |

| Financials | 27.4 |

| Health Care | 14.0 |

| Industrials | 10.0 |

| Information Technology | 6.2 |

| Materials | — |

| Real Estate | — |

| Utilities | — |

| Other | — |

| Total | 100.0% |